The anti-competitive nature of mergers

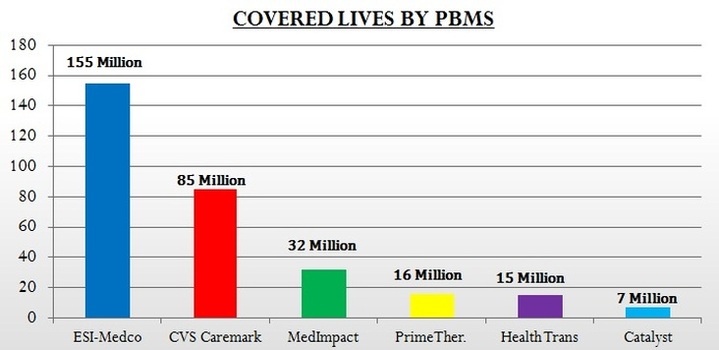

The FTC describes the market as competitively healthy. We would counter that three PBMs dominating 85 percent of their market tier is hardly diverse competition. Furthermore, the absence of strong competing forces allows PBMs to pocket rebates, lacking the incentive to cut costs for consumers by passing along those savings. In fact, rebates have tripled to over $170 billion between 2012 and 2018, with increasingly smaller portions of rebates being passed on to patients. ESI and CVS have acquired or driven out rival specialty pharmacies, expelling them from their networks, and targeting their consumers.

The FTC describes the market as competitively healthy. We would counter that three PBMs dominating 85 percent of their market tier is hardly diverse competition. Furthermore, the absence of strong competing forces allows PBMs to pocket rebates, lacking the incentive to cut costs for consumers by passing along those savings. In fact, rebates have tripled to over $170 billion between 2012 and 2018, with increasingly smaller portions of rebates being passed on to patients. ESI and CVS have acquired or driven out rival specialty pharmacies, expelling them from their networks, and targeting their consumers.